August 13

How Payment Processing and Billing Are Different

At Cheddar, we receive a lot of questions from startups about the payment and billing industry. Typically, one the most common questions we receive are about differentiating payment processing and billing. While the two go often go together, they are quite different when broken down.

Payment Processing: the Act of Moving Money

There are a lot of payment processors on the market. At their core, these companies ensure the process of moving money from a customer to you goes smoothly.

There are a lot of payment processors on the market. At their core, these companies ensure the process of moving money from a customer to you goes smoothly.

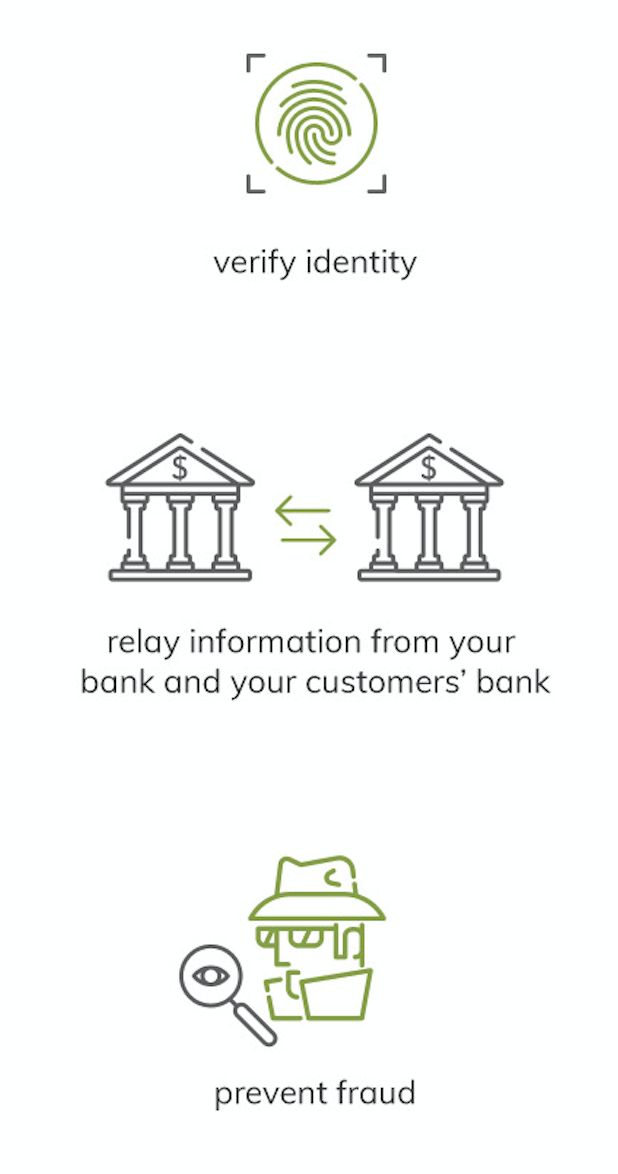

To do this, payment processors verify account information, make sure no one commits fraud, and in general, relay information from the acquiring bank (who receives money) and the issuing bank (who sends money).

Payment processors typically charge a percentage and a per-transaction fee. Due to the number of payment processors, the industry’s rates have commoditized. The standard payment processing rate for card not present (online) transactions is 2.9% plus $0.30 per transaction.

Payment processors charge a percentage of revenue because their business is inherently risky.

As the amount of money you’re moving from one bank account to another increases, so does the risk associated with the transfer, mainly due to payment fraud. If you move $100, you’re dealing with $100 worth of risk, but if you move $1000, you undertake $1000 worth of risk, ad infinitum.

Billing: Knowing When and How Much Money to Move

There are relatively fewer billing systems on the market than payment processors. These companies’ core service is providing an interface and logic to help you tell your customers that they owe you money.

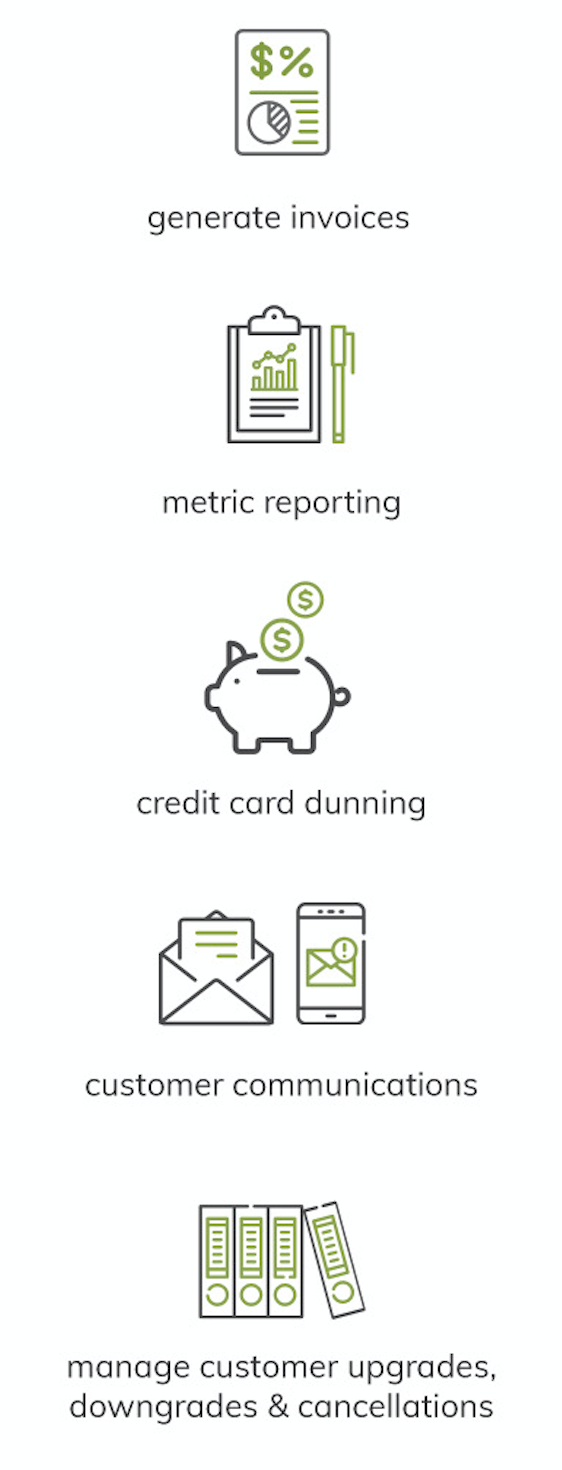

In addition to maintaining the logic around calculating how much to charge and when, most online billing systems also provide services like:

- Invoicing: creating a document that says which products or services to charge for

- Dunning: telling your payment processor to try again if a card fails

- Email communications: sending invoices to customers

- Managing subscription metrics: tracking customer lifetime value (LTV), conversion rates from free accounts to paid accounts, and churn rate

- Managing customer plans: handling upgrades, downgrades, and cancellations

- Switching payment processors: letting you switch payment processors if you negotiate or find a lower rate

A lot of billing systems on the market charge a percentage of revenue for these services—perhaps due to their close association to payment processors—but Cheddar fundamentally believes in the opposite.

Cheddar doesn’t charge a percentage of revenue because there is no inherent risk associated with billing.

While there is “risk” that a customer doesn’t pay you, that risk is held by your company, not by your billing system.

Paying a percentage of revenue just to use your billing system is like paying a percentage of revenue to use your customer relationship management (CRM) software. There is no risk. We believe it makes the most sense to charge a subscription fee to access the platform, a per-use charge for each invoice generated, or some combination of the two.

Have more questions about billing or payment processing for SaaS companies? We’re happy to help—tweet at us!

[Click here for a full infographic on the difference between billing and payment processing]

About Cheddar

Billing built for developers. Cheddar is a usage-based billing platform that helps you track customer activity, iterate your pricing, and optimize your revenue so you can focus on building awesome products, not billing for them. Made with ❤ from the Midwest.