July 25

How to Price SaaS Software: 3 Things That Influence Pricing Over Time

There are several online guides to help you pick a particular SaaS pricing strategy, but there are much fewer resources that discuss how to price SaaS software through updating and iterating your pricing like product development.

Treating pricing with an iterative mindset can impact your startup’s success as much as applying lean principles to product development. Pricing studies show that iterative pricing can improve your lifetime value (LTV) to customer acquisition cost (CAC) ratio from as much as 3:1 to 11:1 and power you through slow periods of growth.

The three most important factors to consider when updating your software’s pricing are:

- Your product’s usage data

- Your costs

- The value of your product to customers

1) Usage: How Customers Use Your Product

When pricing SaaS software, knowing how your customers actually use your software is critical to understanding your different customer segments. You can also see if you’re successfully catering your SaaS pricing model to each segment.

To best leverage usage data in your next pricing iteration, you need to answer two important questions:

- Which features are my customers using?

- How much are my customers using my features?

The first question will help you bundle your software into better plans based on available features within your software. The second question will help you set a better price based on the number of times customers use metered components of your software.

Example – How much are my customers using my features?

MailChimp, one of the most successful bootstrapped companies, attributes a lot of its success to its relentless pricing experiments.

In a blog post, MailChimp CEO, Ben Chestnut, stated the company religiously tracked profitability as it relates to order and usage volume. Like a lot of other companies that have adopted usage-based billing, MailChimp centered its pricing around one value metric. MailChimp’s value metric focuses on the number of subscribers on a customer’s email list.

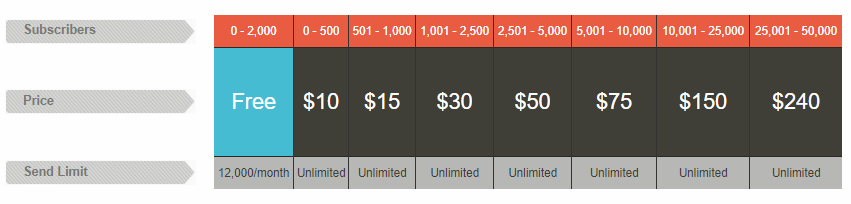

On one of its earlier pricing pages, you can see MailChimp had larger pricing gaps as its customers grew their subscriber bases. MailChimp charged its customers:

- $15/month for up to 1,000 subscribers

- $30/month for up to 2,500 subscribers

- $50/month for up to 5,000 subscribers

- Etc. until its customer hit 50,000 subscribers

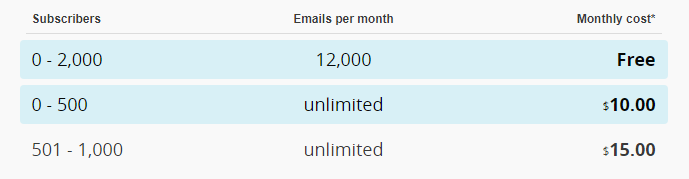

Before pricing change – additional 500 subscribers/$5 increments until 1,0001 subscribers

Through its pricing experiments, MailChimp likely realized that the inconsistent usage gaps didn’t make sense. The gaps were too wide, and the company neglected customers who were on the edges of usage plans. Put another way, MailChimp forced customers in the bottom end of subscriber tiers to pay too much for its software.

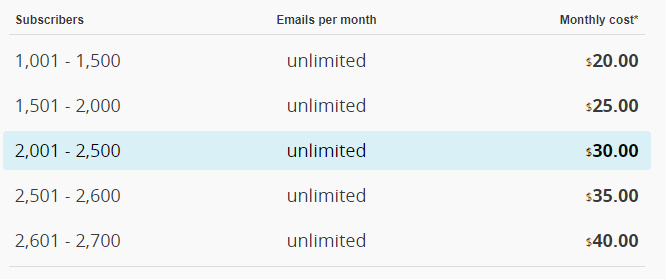

Soon enough, MailChimp changed its tiers. To continue with 500 subscribers at $5 increment until 50,000 subscribers and beyond. While it might seem like a subtle change, these pricing iterations based upon customer usage levels have helped propel MailChimp to generate more than $400 million a year in revenue.

After pricing change – additional 500 subscribers at $5 increments indefinitely

2) Costs (to sell and deliver)

When determining how to price SaaS software, understanding costs and how they change is critically important. Knowing the lowest possible price you can charge and still operate profitably is essential for a successful SaaS business.

When people start to think of their costs, they often turn to their cost of goods sold, or COGS. In SaaS, however, the largest chunk of your costs is determined by how you decide to sell your product. COGS for software—server space, hosting, and 3rd party services—are relatively negligible. Consequently, your customer acquisition cost (CAC) becomes one of your most important cost metrics. Your CAC is made up of expenses to sell your software by acquiring more customers. This might include researching prospects, creating marketing content, offering a free trial or freemium account to customers, and spending money on advertising. As you evolve as a company, these costs will too.

Example – adapting pricing to an evolving CAC

Let’s run through a scenario with a fictional product, Swiss. Starting out, you might want to sell Swiss by targeting individuals through online marketing. By casting a wide net, you might be able to operate profitably by selling your product for as low as $9/month.

At some point you’ll likely see profitability slow down. Swiss can’t reach all potential customers solely through online marketing. To sell to those that require a higher level of trust, you’ll have to do more higher-touch sales. This might include individual walkthroughs, product evangelism, or webinars. You will need to increase prices to compensate for the additional overhead associated with these sales tactics. In addition to this, you will also need to support your growing number of customers. You might have to sell your product for $99/month or more in order to maintain profitability.

Eventually, you’ll want to move up to enterprise sales and sell a product company-wide. Enterprise sales are much more high-touch than selling to startups or medium-sized businesses. The process of making a sale is much more involved. Enterprise sales may require phone calls, in-person meetings, plane rides, and longer sales cycles. Your enterprise CAC might now require you charge upwards of $5,000 per month to maintain profitability.

As you evolve how you sell your product, be sure to always consider how your customer acquisition cost will change.

3) Value of Your Product (to customers)

Understanding the value of your product to customers is important for knowing the upper limit of where you can price your SaaS software.

As a good rule of thumb, companies can charge a between 10% to 50% of the cost savings or additional value created by your product. The clearer the return on investment (ROI) from similar use cases, the more you can charge. This allows you to push the fraction of the cost savings or value created in your favor.

As you increase the price of your SaaS software, the more your potential customer will look for other options. They may want to build it themselves or turn to a competitor instead of buying it from you. As a result, it’s important to always consider your software’s price in the context of your competitors. Its also important to publish case studies from your past customer to justify a higher price.

Long term, the value of your product for a specific customer segment should be correlated with a value metric. A value metric is a measurable component of your software which closely aligns with the value your customers receive. The more your pricing plans revolve around this value metric, the more attractive your pricing will be. Customers of all sizes will be more drawn to use your product. Additionally, a well-tuned pricing plan focused on a value metric allows your pricing to scale with customers’ growth. As a result, you’re left with a higher lifetime value and lower churn.

It’s important to note a company’s pricing model likely shouldn’t only be based on a single value metric. The exception here is for software that is extremely specific. Depending on the business model, many of the following companies make use of a price tiering strategy. This strategy sets tiers of features to divide up different customer segments or buyer personas. Within each tier, product pricing scales with the value metric.

Common Value Metrics by Software Type

| Type of Software | Companies | Value Metric | Other Comments |

| Project management and team communications | Slack, Monday, Asana | Active users

(team members) |

Positive network effects increase with each active user |

| Customer relationship management (CRM) | Salesforce, Zoho, Pipedrive | Active users (sales/business development team) | The size of customers’ sales teams directly affects how many valuable actions (calls and personalized emails) that can be taken |

| Cloud communications | Twilio, Bandwidth | Texts, calls, phone lines, etc. | One of the most granular examples of a value metric |

| MailChimp, SendGrid | Subscribers and emails | The number of subscribers and the number of emails are both used, depending on the company | |

| Payment Processing | Stripe, Braintree | Money processed | The greater the amount of money, the greater the risk due to chargebacks, fraud, etc. |

| Billing | Cheddar | Transactions | Each transaction involves knowing how much to bill and when. This isn’t a percentage because there isn’t an increased risk. |

| Media Streaming | Netflix, Spotify | simultaneously streaming devices | It’s too hard to fight password sharing for most other pricing models when it comes to unlimited streaming |

Example – Adjusting for a value metric

Let’s consider Gouda, a fictitious customer relationship management (CRM) software.

Gouda goes to market with a CRM system they believe can save the average 20-50 person size company a clear $1,000 per month. After thinking about its cost savings and the additional value added by its software—being able to engage and form relationships with a long list of contacts—Gouda initially prices its SaaS product at $50 per 200 contacts per month.

Over the next year, Gouda realizes that most of its customers are startups. They also notice a lot of them churn once they reach more than 1,000 contacts ($250/month). They find that the average Gouda account had 3 or 4 users at the time of leaving Gouda.

After asking one ex-customer why they decided to pursue another CRM software, they reported that Gouda’s software was great, it just became too costly. The ex-customer had lists of 2,000 contacts they wanted to filter, but they didn’t see the value in immediately paying another $500 a month. After all, their sales team can only engage a finite number of prospects at once

Gouda updates its pricing. Instead of pricing by the number of contacts, Gouda priced by the number of users that could simultaneously use its software ($75/user/month) to engage prospects. After making the change, Gouda saw its churn rate drop. Customers continued staying with them from startup to scale up and beyond. As customers grew, hiring more people to use Gouda’s software, so did Gouda’s revenue.

A cheesy example? You bet. But the lesson is clear: be careful what you choose your value metric to be, and be open to changing it.

Not every SaaS company that systematically experiments with pricing becomes a successful, sustainable company. On top of pricing, startups need great products, better teams, and the right timing.

However, treating your pricing with as much criticism as your product and paying attention to your product’s usage, costs, and value, and will help your company get closer to success as your industry evolves.

If you’re ready to create the next iteration of your pricing model, sign up for our Pricing Bootcamp. Over the free email course, you’ll receive templates, example spreadsheets, and other information that will walk you through each of these inputs and other pricing strategies step-by-step.

About Cheddar

Billing built for developers. Cheddar is a usage-based billing platform that helps you track customer activity, iterate your pricing, and optimize your revenue so you can focus on building awesome products, not billing for them. Made with ❤ from the Midwest.